Table of Content

Estate planning is an essential step in ensuring your aging loved ones are cared for and your family’s legacy is protected. For families with aging loved ones, careful preparation can prevent unnecessary stress and help you avoid potential conflicts down the line. Here are some practical estate planning tips to guide you through the process.

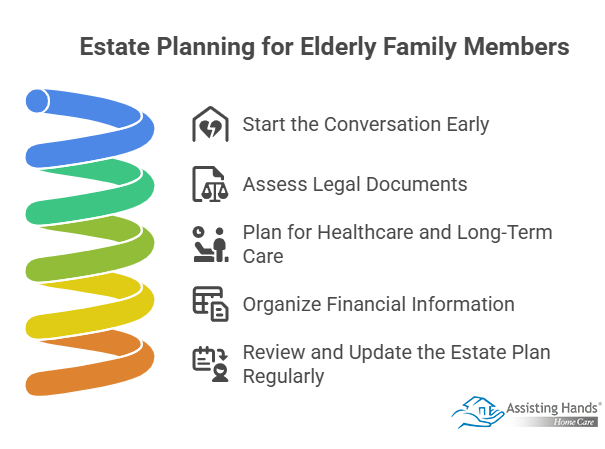

Start the Conversation Early

Talking about estate planning can be tough, especially when it involves aging loved ones. However, starting the conversation sooner rather than later is key.

- Choose the right time and setting to make it comfortable for everyone involved. Avoid waiting until a crisis occurs.

- Frame the discussion around your shared goals, such as ensuring their wishes are honored and avoiding burdening the family with tough decisions.

- Encourage an open dialogue so questions, concerns, or priorities can be addressed directly.

Starting early allows time to explore options and ensures no critical details are overlooked.

Planning for your loved ones’ future should also include considerations about their ability to continue aging in place. Living alone at home in the golden years can present a few unique challenges. Trust elder care professionals to help your senior loved ones maintain a higher quality of life while they live with illnesses and perform the daily tasks of living.

Assess Legal Documents

Having the proper legal documents in place is foundational to estate planning. Here are the key ones to review or establish:

- Last will and testament – Ensures your loved ones’ assets are distributed according to their wishes.

- Power of attorney (POA) – A designated individual can manage financial or legal matters if your loved ones are unable to do so.

- Living will and healthcare proxy – These documents outline their medical wishes and designate someone to make medical decisions on their behalf.

- Trusts (if applicable) – Setting up a trust can help you manage assets, protect them from probate, and provide more control over their distribution.

Work with an experienced estate attorney to ensure all documents comply with state laws and address your loved ones’ specific needs.

Plan for Healthcare and Long-Term Care

Medical care and long-term support are often major concerns as loved ones age. Ensure they have provisions in place to manage their needs:

- Medicare/Medicaid eligibility – Research your loved ones’ eligibility along with supplemental insurance options to cover additional costs.

- Long-term care insurance – If available, this can reduce the financial burden of in-home care, assisted living, or nursing home care.

- Advance directives – Confirm your loved ones’ preferences on end-of-life care are clearly outlined.

Factoring in healthcare and caregiving considerations ensures peace of mind for both seniors and their families.

Some seniors only require help with a few daily tasks so they can maintain their independence. However, those living with serious illnesses may need more extensive assistance. Luckily, there is professional live-in care Fremont seniors can rely on. Home can be a safer and more comfortable place for your loved ones to live with the help of an expertly trained and dedicated around-the-clock caregiver.

Organize Financial Information

Maintaining a complete record of financial information is critical for smooth estate administration. Here’s what to include:

- List of assets and liabilities – Include properties, bank accounts, stocks, retirement accounts, debts, and loans.

- Insurance policies – Document life, medical, and property insurance details.

- Beneficiary designations – Double-check beneficiaries listed on accounts and policies to ensure they align with current wishes.

- Key contacts – Maintain a list of important contacts (e.g., financial advisors, attorneys, and insurance agents).

An organized financial overview can minimize confusion and delays when managing assets.

Review and Update the Estate Plan Regularly

Estate plans should be dynamic and reflect any changes in circumstances or goals. Review the plan every few years to ensure it remains current. Common reasons to update include:

- Marriages, divorces, or the births of new family members

- Changes in financial status or the acquisition of significant assets

- Updates to tax laws that may impact the estate

Proactive reviews ensure the estate plan evolves alongside your family’s needs.

It’s also essential to determine your loved ones’ preferences for continuing to live at home as they get older. If you have senior loved ones who need help maintaining a high quality of life while aging in place, reach out to Assisting Hands Home Care, a leading provider of in-home care Fremont families can trust. Our caregivers help seniors focus on healthy lifestyle habits such as eating nutritious foods, exercising regularly, and maintaining strong social ties, and we offer mentally stimulating activities that can boost cognitive health and delay the onset of dementia. For compassionate, reliable in-home care, trust the experienced professionals from Assisting Hands Home Care. Reach out to one of our dedicated Care Managers today to learn about the high quality of our in-home care services.